A bounce back in macro this week (both ‘hard’ and ‘soft’ data better than expected)…

Source: Bloomberg

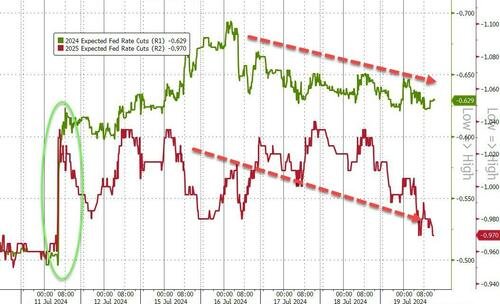

….stalled the ‘bad news is good news’ shift in rate-cut expectations…

Source: Bloomberg

The world’s largest IT outage today did nothing to help the week as CrowdStrike accidentally confirmed the reality of an ‘almost internet kill-switch’…

…leaving Nasdaq suffering its worst week since April (with MAG7 basket down around 4%). Small Caps and The Dow ended the week higher while S&P joined Nasdaq in the red…

The relative underperformance of Nasdaq vs Small Caps in the last two weeks is the largest since the reversal at the top of the dotcom bubble in 2001…

Source: Bloomberg

But bear in mind that this leaves Nasdaq only down a little in July while Russell 2000 remains up over 7%…

Source: Bloomberg

The cap-weighted S&P underperformed the equal-weight S&P by 250bps this week (the most since Nov 2020 – election/vaccines) and by 450bps in the last two weeks…

Source: Bloomberg

The Magnificent 7 stocks have lost $1.3 trillion in market cap since the peak on 7/10 – the biggest 7-day drop for that basket ever…

Source: Bloomberg

VIX had a big week, surging back above 16 – its biggest absolute weekly jump since March 2023 (SVB implosion)… but bond vol remains muted….

Source: Bloomberg

..and it wasn’t just VIX – skews all started to blow out this week…

Source: Bloomberg

…and implied correlation surged back off record lows…

Source: Bloomberg

Bonds were also sold alongside stocks, with Treasury yields ending the week up around 5bps across the whole curve…

Source: Bloomberg

Bitcoin rallied for the second straight week (its best week since March), back above $67,000 for the first time in six weeks …

Source: Bloomberg

…as ETF inflows strengthened…

Source: Bloomberg

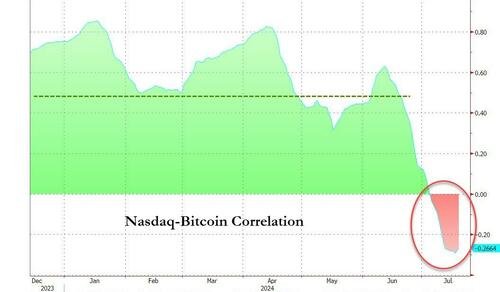

Most notably, Bitcoin has decoupled from its strong correlation with tech overall in the last two weeks…

Source: Bloomberg

Ether was also bid, breaking out above $3500 for the first time in a month ahead of next week’s expected ETF launches…

Source: Bloomberg

Gains in gold earlier in the week were erased as the precious metal ended the week basically unchanged…

Source: Bloomberg

The dollar Index surged back to the highs of the week today and yesterday – ending the best week for the greenback since early June…

Source: Bloomberg

Dollar gains clubbed crude as WTI tumbled back to an $80 handle – the lowest in a month (from two-month highs)…

Source: Bloomberg

Finally, is it over?

Source: Bloomberg

Too soon?

It is for someone!!

Source: ZeroHedge News

Disclaimer: TruthPuke LLC hereby clarifies that the editors, in numerous instances, are not accountable for the origination of news posts. Furthermore, the expression of opinions within exclusives authored by TruthPuke Editors does not automatically reflect the viewpoints or convictions held by TruthPuke Management.