Authored by Charles Hugh Smith via OfTwoMinds blog,

This time around, the Fed may not be able to “save” the bubble from a complete round-trip deflation, which history suggests might decline by 50%.

Let’s start by stipulating that my interest in housing bubbles is purely abstract. I’m not rooting for any set of participants or betting on housing going up or down. My approach is to simply look at the dynamics in play and consider what history offers up as potential trajectories. Rick Blaine summed up this perspective in the film Casablanca: “I understand the point of view of the hound, too.”

With that said, all bubbles pop, and every bubble is declared “the new normal” that will only continue inflating to new heights just before it pops. Housing only goes up, there’s a permanent shortage of housing, and so on.

The bias in reporting bubbles bursting is on the losers, those whose fortunes deflated along with the bubble. But there are also winners when bubbles burst, as what was unaffordable becomes affordable again, and capital that was chasing speculative gains is mangled, and duly chastened, seeks safer returns. Both of these dynamics offer rewards to those who avoided the speculative bubbles.

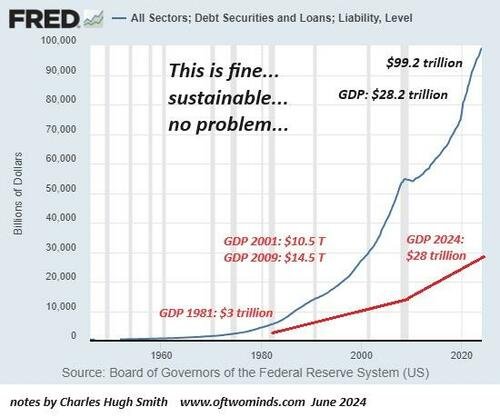

For context, let’s start with the wellspring of the housing bubble, credit. Asset bubbles can arise without credit expanding–the South Seas Bubble, etc.–but in the modern era, gargantuan increases in credit (a.k.a. debt) pump up asset bubbles. Absent a vast expansion of credit, it’s hard to inflate a massive speculative bubble.

Here is total credit in the U.S. Even the casual observer will note that the parabolic rise in credit has outstripped the real economy (GDP). As bubbles rise in assets such as stocks, the phantom wealth leaks out of the first bubble and seeks more fertile speculative ground in another asset class, which then bubbles up in a speculative frenzy.

When credit bubbles pop, asset bubbles pop, too as the constant pressure of new money is what kept the bubbles inflated.

The consensus holds that housing is bubbling higher because there are enormous scarcities in housing: demand exceeds supply, and so prices skyrocket. While this is undoubtedly true in specific locales, the nation as a whole has more housing units per capita than ever before.

This suggests housing hoarding by the wealthy as a factor: corporations have snapped up tens of thousands of homes as rentals, a double play of steady income from rising rents and a speculative bet on gains from additional appreciation. Wealthy households have snapped up hundreds of thousands of homes as short-term vacation rentals (STVRs) for the same reason: income and appreciation.

Millions of homes are empty or lightly used as wealthy families have no pressing need to sell vacation homes, homes left empty when the parents passed or moved to assisted living, etc. Riding the bubble higher is an obvious motivation to hang on to empty houses.

The top 10% who collect roughly half the income and own over 90% of all stocks own 44% of the nation’s real estate wealth. The bottom 50% who own a meagre 2.6% of the nation’s financial wealth own 11% of the real estate wealth. The middle class–the 40% between 50% and 90%–own about the same percentage (45%) as the top 10%.

How do we explain this concentration of real estate wealth in the top 10%? Of course the wealthy own more expensive homes, but this alone cannot account for the outsized share of real estate wealth held by the top 10%: the top 10% own the lion’s share of second homes, STVRs, privately owned rentals and “land-banked” homes that are empty or lightly used.

Unsurprisingly, real estate wealth is concentrated in the older generations, with Boomers and older holding over half and Gen X (ages 44 to 60) with 30%–all together, a massive 82% of the nation’s real estate wealth.

The winners and losers when the housing bubble pops are clear: the younger generations win, the older generations lose, and those who counted on the phantom wealth of bubbles lasting forever will lose while those who didn’t enter the speculative bubble will win.

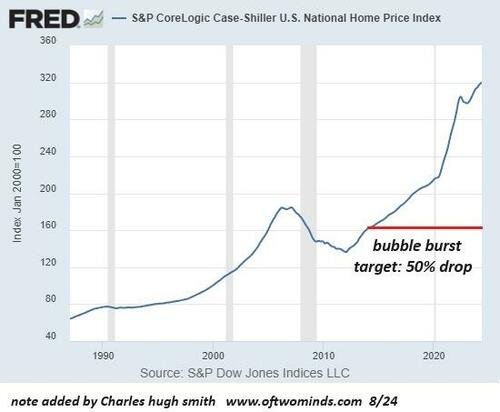

All bubbles pop, and assets fall to levels that everyone at the top of the bubble agrees are “impossible.” The Federal Reserve socialized the housing market starting in 2010 to arrest the deflation of the 2006-07 housing bubble by buying trillions of dollars of mortgage backed securities (MBS). This is visible in the chart of the Case-Shiller National Home Price Index:

This time around, the Fed may not be able to “save” the bubble from a complete round-trip deflation, which history suggests might decline by 50%. Yes, yes, we’re millions of housing units short of demand, etc., but speculation has driven hoarding to levels that are not easy to measure. Once the credit bubble pops, all assets driven higher by speculative credit will pop, including housing.

Yes, a 50% decline is “impossible.” But let’s check back around 2032 to see what’s possible and impossible then. As I often note, if we own a house free and clear and have no interest in using it as a speculative gamble or collateral for extracting phantom wealth via a home equity line of credit (HELOC), then the market value is of no concern. Whether the house is worth $10,000 or $10 million doesn’t matter; what matters is its utility value as shelter we own and control.

* * *

Source: ZeroHedge News

Disclaimer: TruthPuke LLC hereby clarifies that the editors, in numerous instances, are not accountable for the origination of news posts. Furthermore, the expression of opinions within exclusives authored by TruthPuke Editors does not automatically reflect the viewpoints or convictions held by TruthPuke Management.